Irs Home Office Deduction 2024 Form

Irs Home Office Deduction 2024 Form – According to the IRS, though, an audit is simply a review of your accounts “to ensure information is reported correctly according to the tax laws and to verify the reported amount . Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the .

Irs Home Office Deduction 2024 Form

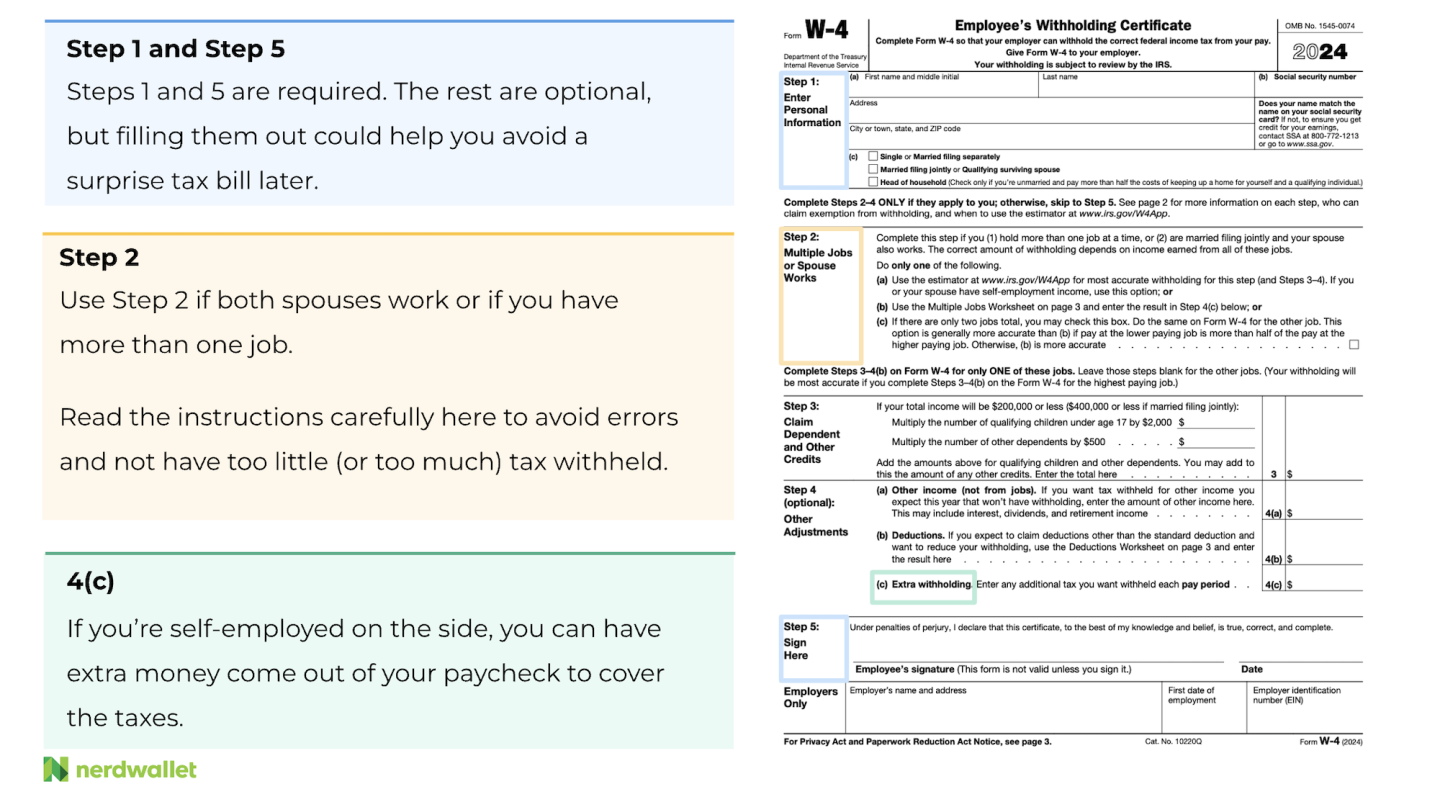

Source : www.irs.govPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.comIRS Form 2441: What It Is, Who Can File, and How to Fill It Out

Source : www.investopedia.comIRS raises tax brackets, see new standard deductions for 2024

Source : www.usatoday.comIRS sets new tax brackets, standard deduction for 2024 | Fox Business

Source : www.foxbusiness.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.comHow to Deduct Student Loan Interest on Your Taxes (1098 E

Source : studentaid.govIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comIrs Home Office Deduction 2024 Form 2024 Form W 4P: If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. . However, not all homeowners can claim this tax deduction, and the rules can be complex. For example, how much you can deduct might depend on when you bought your home for a Form 1098 from your .

]]>

:max_bytes(150000):strip_icc()/form-2441-child-and-dependent-care-expenses-definition-4783504-final-0464752338624545a391b2f2db97b354.png)

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)